Most Recent Resource Articles

Happy New Year and Happy Financial Wellness Month!

Happy New Year! January is not only a typical time for us to reflect on the previous year [...]

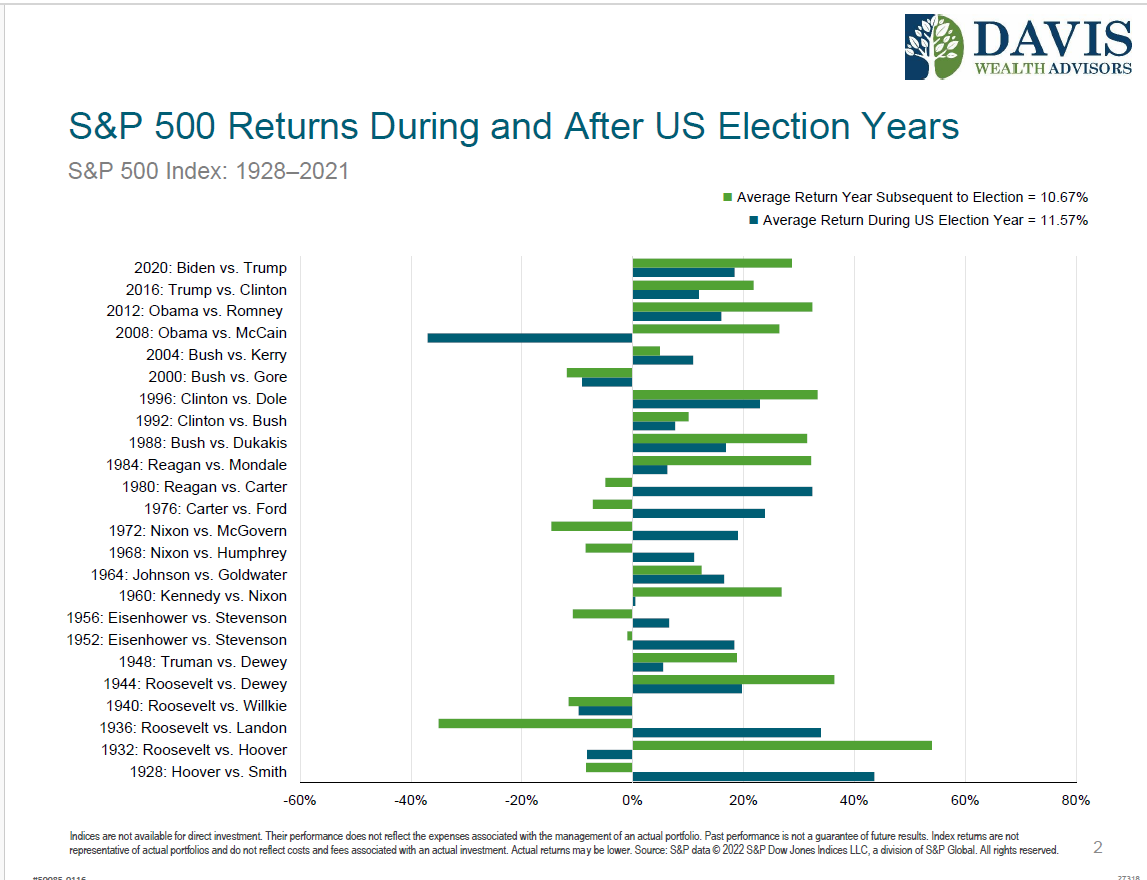

Stock & Bond Returns During Election Years

The SECURE 2.0 Act, which was passed in December 2022, made a significant change to the IRS catch-up contribution rules. The catch-up contribution allows those aged 50 and above to contribute an additional $7,500 to an employer-sponsored pre-tax retirement plan.

Q4 2023 DWA Investment Update

Click the link to view the Q4 2023 DWA Investment Update.

Q3 2023 Market Slides

Click the link to view the Q3 2023 Market Slides.

The Roth-Only Catch-Up Contribution Rule Will Get Time to Catch Up

The SECURE 2.0 Act, which was passed in December 2022, made a significant change to the IRS catch-up contribution rules. The catch-up contribution allows those aged 50 and above to contribute an additional $7,500 to an employer-sponsored pre-tax retirement plan.

October Market Commentary: A New Era for the Economy Creates Uncertainty

The outcome of the Fed's meeting in September was to hold rates at the current level. It has been described as a "hawkish pause," and the Fed was clear in post-meeting remarks and statements that one more increase is still possible in 2023.