Determining when to take social security, as well as planning for your future benefit, is such an important part of retirement planning. For each couple or individual, the answer as to when is the best time to take your benefit is different.

Determining when to take social security, as well as planning for your future benefit, is such an important part of retirement planning. For each couple or individual, the answer as to when is the best time to take your benefit is different.

It may seem like waiting until age 70 is best, as you can increase your annual benefit by as much as 32% by waiting. However, there are times when this is not the best plan. Work with a financial planner who understands your risk tolerance, income sources in retirement, and your long-term goals and cash needs to find out what the best solution to optimize your benefit is.

In the meantime, here are some basics to know about social security as you get closer to the next phase of life:

How is Your Benefit Calculated?

Social Security calculates your benefit by taking your average indexed monthly earnings during the 35 years you earned the most. Indexed earnings are earnings that have been adjusted to account for wage growth in the economy, as measured by SSA’s average wage index (AWI).

For individuals who have not reached the age of 62, the social security benefits shown on your statement for age 62, full retirement age and age 70 are calculated based on having earned income until age 62 at the same rate as you earned in the current year. Higher earnings or working longer than age 62 might increase your benefit. If you do not have earned income for 35 years, there will be a zero value used in the years you did not earn.

Here is an example. Sally goes to work after college and works for 3 years before staying home with her children at age 27. She goes back to work when she is 45 and works until she is 63. She has 21 years of earned income. When calculating her benefit, the total of her 21 years of indexed earnings will be summed and divided by 35. If she works up until her full retirement age of 66, she will increase her social security benefit by adding 3 more years of earnings.

Another example: If you began working at the age of 24, and worked until you were 61, you would have 37 years of earned income. If you worked part-time from age 61 to your full retirement age of 66, it would not negatively impact your social security benefit because you had already met the minimum 35 years for calculation purposes. Your estimated benefit on your Social Security Statement does assume you will be earning at your current income until you reach the age of 62, so if you plan to retire before that, it would be important to get a more accurate estimate from a Social Security representative.

For every month you delay your retirement past full retirement age, you receive additional credits, increasing your benefit 8% per year. This can be pro-rated if you decide to take benefits at age 68 ½.

When to apply?

You should apply for social security 3-4 months before you are eligible by either applying online at www.ssa.gov or making an appointment with a Social Security Representative. You become eligible the month after either your 62nd birthday (at a reduced payout) or the month after your full retirement age.

For example, if Larry’s full retirement age is 66, and his birthday is May 9th, he will be eligible the following month in June. Checks are sent the month following eligibility if your application was done at least 3 months before your birthday. If Larry applied in February, he would become eligible in June and receive his first check in July.

The date of your check is based upon your birthday. If your birthday falls the 1st-10th you should receive your check the 2nd Wednesday of the month. If your birthday falls the 11th- 20th you should receive your check the 3nd Wednesday of the month, and you will receive it the 4th Wednesday of the month is your birthday falls the 21st – 31st. Therefore, Larry, who turned 66 on May 9th, would receive his first check the 2nd Wednesday in July. If Larry had not applied until May, he might have had to wait three months before his first check would be sent.

Is My Social Security Benefit Taxed?

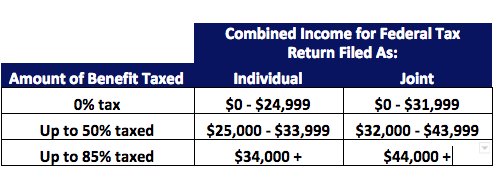

Some people have to pay federal income taxes on their Social Security benefits. This usually happens only if you have other substantial income (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return) in addition to your benefits.

No one pays federal income tax on more than 85 percent of his or her Social Security benefits based on Internal Revenue Service (IRS) rules. The IRS determines how much is taxable based on your “combined income”.

Your adjusted gross income + Nontaxable interest

+ ½ of your Social Security benefits = Your “combined income”