This is a guest post by Matt Rudnick, Founder and CEO of Main Sheet, an M&A advisory firm for entrepreneurs of middle market companies looking to sell their business.

We’ve covered how to evaluate your readiness to sell your business, and we’ve outlined how to do your own due diligence to build your business value prior to the sale.

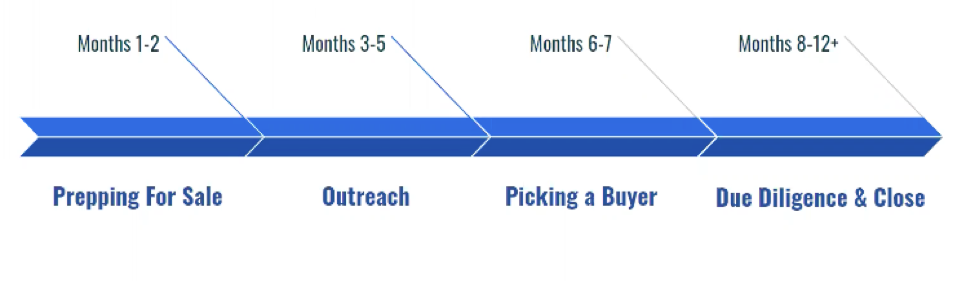

Now we’re down to brass tacks—how do you sell a business? Let’s take a look at the process and timeline. What are the stages and steps you need to go through to actually get your business sold?

When most entrepreneurs sell their businesses, the deals follow a certain progression or journey. Having a process in place that follows this approximate progression helps prospective buyers to see that you’re a professional that’s serious about a sale, and they’ll know when to expect their own action items (such as submitting a letter of intent or LOI).

I’ve seen deals take as little as nine months, and others take significantly longer, but all deals start with preparation.

1-2: Prepping for Sale

Ready to sell? Great, then it’s time to position yourself for success. Preparation includes several key steps:

- Gather your financials. Calvin Wilder, Founder and CEO at SmartBooks, covered this topic pretty extensively in our last post. I highly suggest working with someone like Calvin for this step.

- Write a teaser. A teaser is a one- to two-page document that gets the attention of potential buyers. You only want to go to market once and attract as many buyers as possible, so include as much as compelling information about your business as you can. This may include your actual business name or a code name. The fewer people you involve in the sale process, the better. A code name might help you limit involvement to only those who are necessary to the sale.

- Assemble a buyers list. This list should include strategic buyers in your industry. These will probably be big companies that want your shiny new toy to plug into their empire. These strategic buyers tend to pay a premium. Your list should also include financial buyers such as private equity groups. These PEGs are buying your profits or geographic footprint, or perhaps you fulfill some other need for them. Check out The Art of Selling Your Business for more on these buyers.

- Reach your network. Have your broker talk to people you know about your intention to sell—competitors, people at conferences, you name it. Get the word out to your existing network as soon as possible.

- Start writing a CIM. Once a prospective buyer has read your teaser, requested more information, and signed an NDA, you can send a confidential information memorandum (CIM). This document contains all of the information a buyer needs to get excited about pursuing your business. It should include analysis of the market, financials on the business (including historical performance), the team you’ve assembled, differentiation that sets your business apart. It should include complete answers to potential buyers’ question: “Why do I care?”

A common pitfall at this stage? Talking to only one buyer. This will limit the prospects of your sale and you may have to go through the process all over again if things fall apart in due diligence.

Months 3-5: Outreach

At this stage of selling your business, you want to get to as many potential buyers as possible by any means necessary—cold call, email, do whatever you need to find everyone under the sun who might want to look at your teaser. Time this outreach stage with an industry event, if possible. I’ve often gone to conferences for clients, visiting each and every booth to hand out business cards—and teasers if I can find a decision maker.

Make sure your outreach is comprehensive. You’ll want to reach out to:

- 100+ strategic buyers.

- Financial buyers. I also have a list of 500 PE firms I send teasers to. You might be tempted to only send your teaser to PEGs with a focus on your industry. But you might not know that they just hired someone to get into your industry or they’ve done some niche work in manufacturing. Err on the side of sending to more potential buyers rather than fewer.

- Family offices. They are popular and active. A family office with deep experience in a specific industry might be investing in food companies, for example and could be formidable investor.

It’s important to get your timing right on this step, so prepare to hit pause if things aren’t lining up perfectly. Don’t send your teaser at end of the year, for example, when everyone is trying to close deals. And when COVID hit, I told most of my clients to take a break—there was no sense in sending teasers when everyone was too preoccupied to consider them.

Months 6-7: Picking a Buyer

If you and your team of advisors have done solid outreach, you’ll have multiple LOIs to consider. These letters may include the price (or a range) the buyer is willing to pay for your business, any applicable deal terms, structure, details on what they plan to do with the company, etc. The LOI is the buyer’s chance to outline why they’d be a good horse to pick.

When evaluating your options:

- Create a data room (if required). This is a secure place to share documents between seller and prospective buyers.

- Set an LOI due date and stick to it.

- Negotiate your LOIs. Go back and forth on each offer you’re entertaining to get the best possible price and terms. If you’re not a strong negotiator, this is the perfect situation to use an advisor.

- Pick a horse. Decide which offer you want to accept.

A common pitfall in this stage of selling a business is failing to consider culture. Look for culture clashes between yourself/your company and the buyer. Are your future visions for the company aligned? Are you open to the new ideas the buyer has for the business? If not, move on or accept that you will lose control eventually. It depends on your immediate goals.

Months 8-12+: Due Diligence and Close

Once you’ve selected your buyer and signed an LOI, it’s time for the buyer to complete due diligence. This can last a few weeks or a few months, depending on the comfort level of the buyer and the complexity of the business. Some buyers may bring in a third party to go through the books and put their stamp of approval on the business.

This stage includes:

- Once you sign the LOI, you cannot talk to any other prospective buyers. If your deal falls apart, you have to wait a period of time before resuming conversations with other prospects.

- Negotiating final documents. It’s important to have an experienced deal attorney negotiate all of your contracts, including the purchase and sales (P&S), employment agreements, etc.

- Closing on the deal.

There are a lot of pitfalls to avoid at this stage of the game, and emotions are running high all around. It’s wise to partner with an experienced advisor that can make sure things don’t run off the rails, keep everyone’s emotions in check, handle difficult conversations, and ensure smooth communication during due diligence. You may be working with an investment banker or a deal lawyer or both, but make sure you have outside help at this stage, at the very least.

Avoid comparison when selling a business

Throughout this process of selling businesses, I often get questions like, “Company X got $50M when they sold. Will I get that much?”

You might, but don’t get hung up on that number.

The other business may have had triple your revenue. They might have had some IP that had huge barriers to entry. They might have hired all the unicorns in your space. Usually, you don’t know why a given company sold for a given amount. I caution you not to compare yourself or your business to others. There are “comps” in your industry, as well as average multiples of EBITDA and revenue—but your number could vary wildly, so be prepared to be above or below average.

More important to consider when determining a price for your business and envisioning personal success is your freedom point. Stay tuned to learn all about how to calculate your magic number for financial freedom.