If you work with a financial advisor or have a work retirement plan such as a 401(k) or 403(b), you have probably heard of rebalancing.

Rebalancing is the act of selling what performed well and buying the underperforming asset classes to get back to your original target allocation.

This assumes that you have determined a target allocation based on your risk tolerance, goals, and time horizon. It takes the emotion out of selling high and buying low.

Rebalancing Portfolio Risk: How it Works

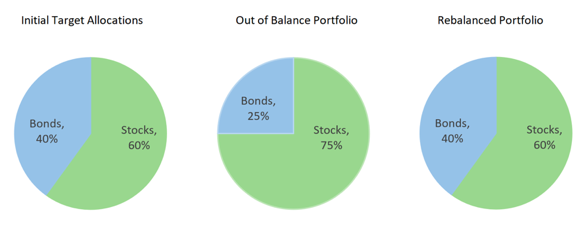

A simple example of this is if you owned 60% US Large Company Stocks and 40% Intermediate-term Bonds. In most cases, the stocks will out-perform the bonds, leading you to take on more risk that you had originally planned. If not rebalanced, it could grow to 75% Stocks and 25% bonds. When a market correction arrives, as they always do, you may see much higher volatility and risk losing more than if you had rebalanced back to 60% stocks and 40% bonds prior to a correction occurring.

Without rebalancing you may take on more risk than you can handle and make an emotional decision during a correction, versus letting your investments ride out the correction and recover.

These emotional decisions erode wealth over time and reduce long-term investment returns. It is important to note that when rebalancing between asset classes with significantly different returns, like stocks and bonds, it can lower long-term returns (using pure math and assuming no emotional decisions are made.) This is because you are selling the higher performing asset (usually stocks.)

If you allow stocks to continue to grow, over time, you may achieve higher returns. However, you will experience much more volatility and may make emotional decisions that will result in a lower investment return than if you had been in the right asset allocation to begin with. Volatility is also important when taking withdrawals from a portfolio. If you have a volatile portfolio and are forced to sell stocks when they are down to create an income stream, it can reduce your long-term return.

Having an agreed-upon rebalancing strategy will improve your long-term investment experience, as well as your risk-adjusted return. Risk-adjusted return is the amount of return you receive for the amount of risk you take on. By rebalancing your portfolio, you should be able to increase the return you get for the amount of risk you are taking on.

Most portfolios have a lot more asset classes than just US Large Company Stocks and Intermediate-term US Bonds. They include international stocks, real estate investment trusts (REITs), US Small and Mid-sized company stocks, and sometimes alternatives such as oil, gold, etc.

When rebalancing between asset classes with similar returns, you can actually enhance returns through rebalancing. For example, US Large company stocks outperformed many other asset classes over the last 10 years. However, in 2015, emerging markets and small company stocks were the best performers.

Optimal Rebalancing Timeframes

Now that we have established that rebalancing is used to manage portfolio risk and enhance returns for asset classes with similar long-term returns, what is the optimal rebalancing time frame? Monthly, annually, every five years? There is not a clear answer on this. A Journal of Financial Planning study by Gobind Daryanani found that once transaction costs are considered, almost any rebalancing frequency greater than annual wasn’t very beneficial.

There are also taxes to consider in non-retirement accounts. Having a longer time horizon to allow the portfolio to capture some of the momentum of a run in an asset class can be beneficial as well. At Davis Wealth Advisors, we target rebalancing annually. However, if an asset experiences significant growth in a short time frame and causes the portfolio to vary significantly from its target, we would rebalance at that time. An example of this would be in 2013 when US Large Company stocks were up 30%+.

If you are contributing to your accounts or withdrawing from your accounts, those contributions/withdrawals can be used to rebalance your portfolio on an ongoing basis.

In summary, rebalancing is important to managing portfolio risk. It should improve your investment experience, may enhance returns of similar performing asset classes over time, and as a total portfolio, may increase your risk-adjusted return. At Davis Wealth Advisors, we believe having an investment process that includes rebalancing ensures our clients will have a good investment experience and will be able to sell high and buy low without trying to out-guess the market or get emotional during market cycles.